This is an archived article that was published on sltrib.com in 2012, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

The confidence of Utah consumers has hit its lowest point in eight months, suggesting that the latest spate of downbeat economic data is corroding optimism about the recovery, Zions Bank said Tuesday.

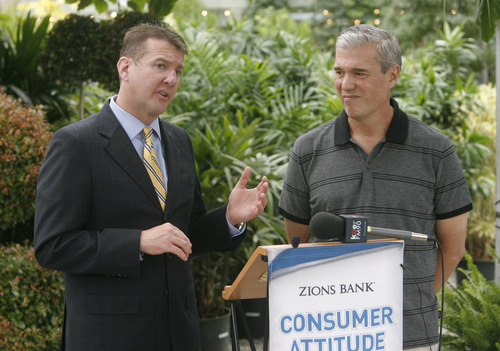

The bank's Consumer Attitude Index fell modestly in July, to 76.7 from 79.7 in June, but was within the statistical margin of error — implying that there was little month-to-month change, said Randy Shumway, CEO of The Cicero Group/Dan Jones and Associates, which randomly polled 500 Utah consumers from July 1 to July 15 for Zions.

Although the index was 9 points above November's reading of 67.7, it was well below the all-time high reading of 84.8 in February, according to Zions figures. The bank launched the index in January 2011.

"We've slowly returned consumer confidence to the same spot we were at at the beginning of the year. I think there was greater optimism at the beginning of the year that things would more quickly escalate in the economy," Shumway said.

Nationally, U.S. consumer confidence rose in July after four months of declines. A better outlook on short-term hiring and lower gas prices offset lingering worries about the economy and poor income growth.

The Conference Board said its Consumer Confidence Index increased to 65.9, from 62.7 in June. That's the highest reading since April and better than the reading of 62 that economists had forecast.

Still, the Utah and national confidence indexes remain below 90, which indicates a healthy economy. The national number hasn't been near that level since the Great Recession began in December 2007. The index fell to an all-time low of 25.3 in February 2009 — four months before the recession officially ended. In Utah, the lowest reading was 59.8, last August.

Consumer confidence is widely watched because consumer spending drives 70 percent of U.S. economic activity. A separate Commerce Department report Tuesday showed Americans spent no more in June than May, even though their incomes grew by 0.5 percent.

Scott Pynes, who owns Cactus and Tropical plant stores in Draper and Salt Lake City, has seen big swings this year. He said sales exploded in the first quarter but that by April they had slowed measurably.

"We [saw] a moderating of the increases we were seeing at the beginning of the year," Pynes said. "Where people were feeling pretty confident at the end of [2011], that confidence has waned, and no one knows why."

Shumway thinks that although gasoline prices have ebbed in recent weeks, they remain high in many people's minds, at above $3 a gallon. Add to that tepid gross domestic product growth, Euro zone worries and political gridlock in Washington, and it's no wonder Utah consumers are blowing hot and cold about the economy, he said.

The Zions index is made up of two components. The Present Situation Index, which measures confidence in current business and employment conditions, decreased 2.4 points. Sentiment about the labor market was unchanged in July, but the number of consumers who view current business conditions in a negative light jumped 5 points.

The Expectations Index, a look forward six months, fell 3.5 points in July, according to Zions.

"Utah consumers feel less optimistic about general business conditions and employment in the next six months than they did a month ago," Zions said in a statement.

Twitter: @sltribpaul