This is an archived article that was published on sltrib.com in 2012, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

In a cash deal valued at $1.6 billion, Ancestry.com has agreed to sell a controlling stake in the Provo-based genealogy website to a group led by European private equity firm Permira Funds.

CEO Tim Sullivan would not say exactly how long the deal had been in the works or how much of Ancestry Permira will acquire when the deal closes early next year. Those kinds of details will come out later, he said.

"It's safe to say that we've been reacting to some interest for several months," he said, adding that he will keep about 75 percent of his stock in Ancestry. Sullivan will continue to run the company.

Sullivan said Ancestry anticipates no changes in its operating structure with the deal. The company will stay in Provo, where the company has about 700 employees, and it will continue to focus on beefing up content and technology, as well as expanding product offerings in areas such as DNA that improve the experience of more than 2 million subscribers. Longer term, Permira's presence in Ancestry will make it possible to accelerate some investments in the company that Ancestry hopes to make, Sullivan said.

Like Sullivan, Chief Financial Officer Howard Hochhauser will stay on in his role and keep much of his equity stake. Spectrum Equity, which was Ancestry's largest shareholder before the deal, with a 30 percent stake, will remain an investor. Spectrum has been an owner since 2007, two years before Ancestry went public.

The offered price Monday of $32 per share was a nearly 10 percent premium over Friday's closing price of $29.18. Ancestry's shares jumped 8 percent, or $2.37, to $31.55 in premarket trading Monday, and had fallen back by the close, to $31.44, up 7.8 percent.

Ancestry operates a website for researching family history and has more than 2 million paying subscribers. It says more than 10 billion records have been added to its site in the past 15 years.

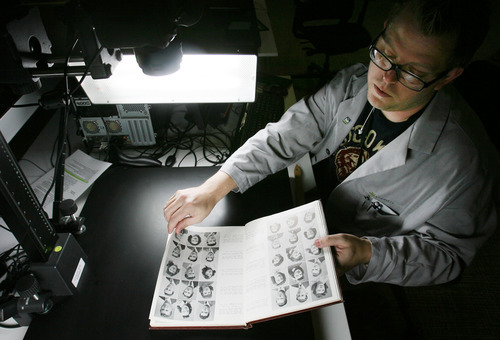

The company said it has developed and acquired systems that digitize handwritten historical documents, and it works with government archives, historical societies and religious institutions around the world.

Last year, Ancestry earned $62.9 million, or $1.29 per share, on nearly $400 million in revenue. The company was founded in 1983 as a publisher of genealogical books and magazines, and later digitized its content. It has made several acquisitions in recent years, the most recent on Aug. 17 when it completed its purchase of Archives.com, another family-history website, from Inflection LLC.

Ancestry said that the price paid Monday by Permira represents a 41 percent premium over its closing price in early June before reports surfaced that the company had retained a financial adviser for a possible sale. Company shares have climbed from around $21 since then and hit a 52-week high of $33.80 in early August before dropping back.

In a letter to employees, Sullivan praised the deal as a plus for everyone involved with the company.

"Other than a change in the capital and ownership structure of the business, we do not anticipate any significant changes in our strategy, mission and organization. We'll continue to run the business as we have in the past," he said.

The deal is "a great outcome for out stockholders, employees and subscribers, and we think it will only enhance our ability to continue investing in our great company. In Permira, we will have a world-class equity partner with great experience in technology, media and the Internet," Sullivan said.

Ancestry will announce third-quarter earnings on Wednesday. Analysts surveyed by Thompson Reuters expect Ancestry to report earnings of 49 cents per share. It earned 44 cents per share in the second quarter ending June 30.

Bloomberg News said Permira obtained financing commitments from five banks to back its $1.6 billion buyout of Ancestry.com — Barclays Plc, Credit Suisse Group AG, Deutsche Bank AG, Morgan Stanley and Royal Bank of Canada.

Ancestry's subscribers pay $12.95 to $34.95 a month to access its content and use its online search tools, according to the company. Most subscribers are in the U.S., Great Britain, Canada and Australia.

The Associated Press contributed to this story —

Other big deals in Utah

Blackstone agrees to buy Vivint, 2012, $2 billion

Adobe Systems acquires Omniture, 2009, $1.8 billion

Novell acquires WordPerfect, 1994, $1.4 billion

Symantec acquires Altiris, 2007, $1 billion

Global Payments Inc. agrees to buy Accelerated Payment Technologies, 2012, $413 million

Cephalon acquires Anesta, 2000, $340 million

Watson Pharmaceuticals acquires Theratech, 1999, $300 million