This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Washington • If immigrants here illegally want to become citizens, they should act like citizens and pay their back taxes, said Sen. Orrin Hatch, who casts the issue as a matter of fairness - and a move that would make the government some money.

But constructing a system to do that isn't easy and it has the architects of the broad immigration bill nervous. They worry added bureaucratic and financial hurdles will make it less likely that the 11 million unauthorized immigrants will start walking down that path to citizenship.

"I want anyone who owes back taxes to pay them," said Sen. Lindsey Graham, R-S.C., one of the eight bipartisan authors of the bill. "But when you are talking about a system where a lot of people got paid under the table with cash it can be problematic."

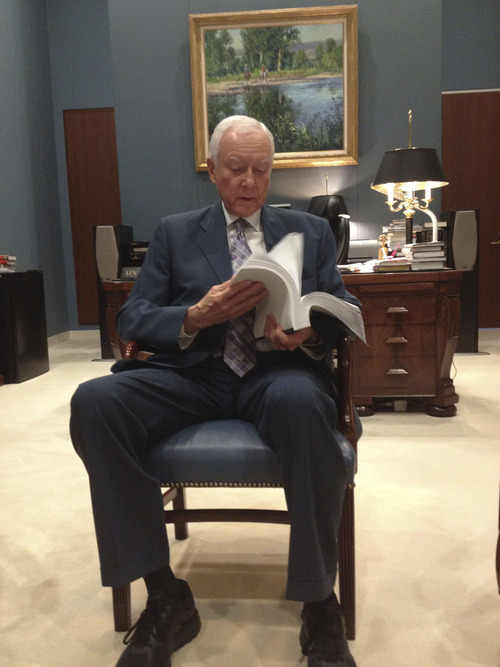

Graham and the so-called "Gang of Eight" have wooed Hatch, R-Utah, for weeks, hoping his endorsement will attract more Republican votes. Hatch supported the bill in the Senate Judiciary Committee, but said his continued assistance is contingent on a few changes, none of which are likely to be as contentious as his demand that immigrants pay taxes and the appropriate penalties for every year they have been in this country illegally.

"All we are saying is get right with our government," Hatch said. "I don't want to treat them any differently. I just want them to realize there is a responsibility in being a U.S. citizen. That helps get us votes here in the Senate and especially in the House."

—

Debate kicks off • The Democratic controlled Senate will start a month-long debate on the bill next week, with supporters hoping for such a large majority that it will pressure the House into action. At this time, the Republican-controlled House is in the process of drafting its own series of immigration bills.

The Senate proposal requires unauthorized immigrants to eventually pay a $1,000 fine and any taxes they have been assessed by the Internal Revenue Service to maintain their new legal status. This provision means immigrants who are paid under the table would not be required to pay any back taxes.

Republicans like Hatch and his Utah colleague, Sen. Mike Lee, have a problem with that. Lee, a Republican who opposes comprehensive reform, tried to amend the bill in committee to say these immigrants must pay any taxes they owe, not just those already assessed by the IRS.

Sen. Chuck Schumer, D-N.Y., has promised to negotiate with Hatch on the issue, but he led the effort to kill Lee's amendment in committee by arguing as many as 5 million unauthorized immigrants may find it difficult, if not impossible, to determine how much they have earned and what they should pay in taxes.

"The worry I have here, " he said, "is that it will delay and prevent many, many, many people from coming out of the shadows."

Schumer promised to seek a compromise "that would allow illegal immigrants who owe back taxes to pay them, but in a practical way that doesn't deter people from coming out of the shadows, coming forward and being able to be here legally."

—

Complications • If there is a way to accomplish that, William McBride, the chief economist at the right-leaning Tax Foundation, doesn't know what it is.

A number of unauthorized immigrants have paid income taxes either through identification numbers provided by the IRS or the use of another person's Social Security number. Figuring out if these people owe any additional taxes is relatively easy.

But the only practical way of doing so for those who have never been part of the system is to trust that the immigrant is correctly estimating income.

"They would just be counting on the honesty of the taxpayers and that is not a great way to go about doing it," said McBride. "Essentially it is not really enforceable."

McBride's skepticism is in part based on his belief that the IRS won't spend much effort auditing immigrants because the agency is stretched thin, conducting the audits would be difficult, if not impossible, and the result wouldn't net the government much money.

"I think it is very difficult in general to go after back taxes in this way and a better route is to just charge a one-time lump sum fee," he said.

—

Burden • Graham and the bill's supporters plan to fight any effort to increase the bill's current $1,000 fee, which some immigrants could pay in installments, for fear that some couldn't afford more.

"How much do you make this, from the illegal immigrant point of view, a burden that can't be borne?" he asked rhetorically.

Madeline Sumption with the Migration Policy Institute, a group that wants to see reforms, said essentially this debate is more about politics and the perception of fairness, rather than good tax policy.

"People don't like the idea that there are some people who should have paid taxes and didn't," she said. "The natural inclination is to want to correct that situation, but the problem is that there are not any good tools to do that."

Hatch and Lee acknowledge their efforts would ultimately rely on the honesty of each immigrant, but they say that's better than not attempting to collect the income tax revenue.

"I don't have a desire to gouge anybody," Hatch said. "Their obligation is to perform like our citizens have to. Why would we expect less from those who really have not played by the rules."

Twitter: @mattcanham