This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Reports of widespread health insurance cancellations may be overblown, at least in Utah, where the two largest insurers say a majority of consumers can keep their current plans through the end of 2014.

In other parts of the country, insurance companies are canceling hundreds of thousands of individual policies — those obtained on the open market, not through an employer — saying they don't fit requirements of the Affordable Care Act (ACA).

The letters directly contradict President Barack Obama's promises that people who like their current plans can keep them, refueling Republican angst over the health law.

While federal officials "tinker" with the problem-plagued insurance portal http://www.healthcare.gov, "millions are losing their current coverage," reads a Monday statement from Senate Republicans in Congress.

But in Utah, where two nonprofit insurers claim 60 percent of the individual market, cancellations have been minimal.

Companies can continue to offer noncompliant plans under a grandfathering provision that allows them to be sold for a year.

Regence BlueCross BlueShield sent expiration notices to 376 subscribers, offering them access to an ACA-compliant plan instead.

"We do not anticipate any further discontinuation of individual plans in Utah in 2013 for 2014," said Regence spokeswoman Teresa Zundel.

Fewer than 1 percent, or about 30 of SelectHealth's individual subscribers, will lose coverage come Jan. 1 because they are enrolled in NetCare plans designed to comply with a repealed Utah mandate, said company spokeswoman Carrie Brown.

"This decision to discontinue," she said, "was made after careful consideration that the coverage available to these members after that date will be at least as good, if not better."

The rest of SelectHealth's 60,000 individual policies will be automatically renewed through the end of 2014, Brown said.

The insurer, however, is reminding customers that they aren't locked into their plans.

"They can shop [for] coverage on the new online marketplace to compare rates, benefits and plans as well as learn about federal subsidies for which they may be eligible," said Brown. "Our goal is to accurately inform members of their options and support them in finding the plan that best fits their individual health care needs."

Though limited in scope, the threat of losing health insurance is unsettling and exacerbated by fears that the health exchange won't be fixed in time to avoid gaps in coverage.

All Utahns will have to switch to ACA-compliant policies come 2015.

U.S. Health and Human Services officials have promised to have healthcare.gov running more efficiently before Dec. 15, 2014, the deadline to buy coverage effective in January.

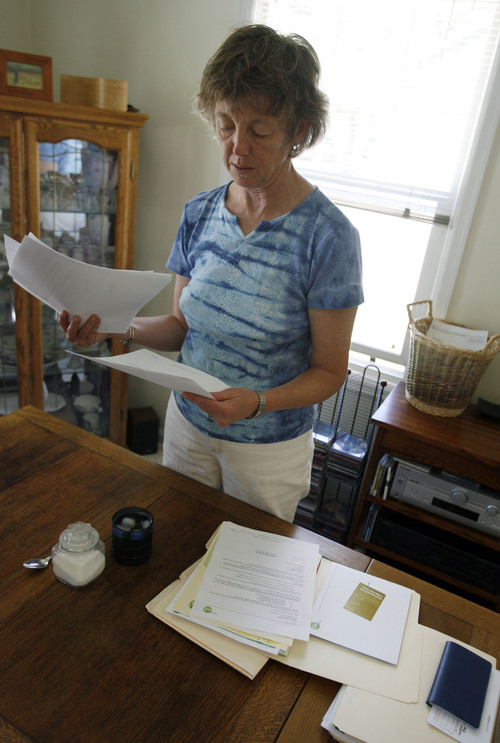

Though she's frustrated by the hang-ups, Mary Brett of Salt Lake City said, "I can wait," provided she's approved for the $760 monthly subsidy she and her husband, Jeff, are estimated to receive.

Humana told the couple that their current plan — for which they pay $400 a month and which carries a $10,000 deductible — is good through the end of 2014. But they're eyeing a bronze-level plan with a $5,000 deductible from Arches that, after subsidies, is expected to cost about $45 a month.

It's long-overdue financial relief, said Brett. Because she and her husband are self-employed, they've been subject to higher health insurance rates for years. "We've been praying for this," she said.

Twitter: @kirstendstewart