This is an archived article that was published on sltrib.com in 2017, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Utahns won't vote on a proposed income tax increase to fund schools until 2018 — if ever — but a new poll suggests organizers of the Our Schools Now ballot initiative are starting out in the lead.

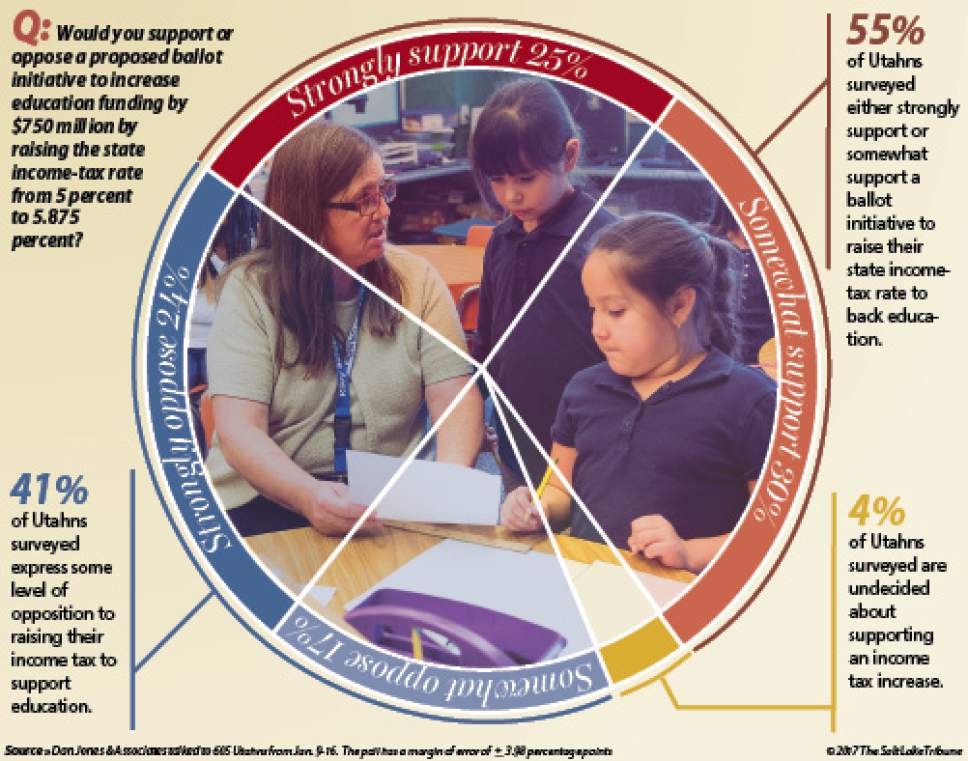

A recent Salt Lake Tribune-Hinckley Institute of Politics survey of 605 registered voters found 55 percent in favor of the measure, which would raise $750 million for public schools by bumping Utah's income tax rate up from 5 percent to 5.875 percent.

The initiative was opposed by 41 percent of respondents, with another 4 percent saying they were unsure if they would support or oppose the tax hike.

"I'm always happy to see it 55-41, rather than the other way around," said Nolan Karras, co-chairman of Education First, which launched the Our Schools Now initiative. "We understand that we have taken on a very difficult task and it will not be easy to try and get the public to support what we're doing."

Poll results contrast sharply with the sentiments of influential Republican legislators of Utah's Capitol Hill.

Both House Speaker Greg Hughes, R-Draper, and Senate President Wayne Niederhauser, R-Sandy, spoke against the initiative during their opening remarks to kick of the 2017 legislative session this week.

Niederhauser said Tuesday that lawmakers would prefer to broaden the tax base by removing or adjusting exemptions and deductions. But he added that there is little chance the Legislature would approve any significant boost to school resources.

Niederhauser called addressing the issue through the state's income tax rate "the absolutely wrong thing to do."

The poll, conducted Jan. 9 through Jan. 16 by Dan Jones and Associates, has a margin of error of 3.98 percent.

Among poll respondents, 63 percent of women backed the initiative, compared to 47 percent of men.

Higher levels of education corresponded with higher levels of support for Our Schools Now, with 58 percent of bachelors and post-graduate degree holders favoring the income tax hike, compared to 45 percent of high school graduates and 37 percent of those with some high school education.

Along party lines, Democrats and unaffiliated voters support the initiative in large numbers — 74 percent and 66 percent, respectively. And among Republican voters, traditionally less receptive to tax increases, support and opposition were statistically tied at 47 percent and 48 percent, respectively — within the poll's margin of error.

"If this was the day of the election and I had 55 percent in favor and the Republicans split evenly," Karras said, "I'd be celebrating."

Utah's public schools are currently the lowest-funded in the nation on a per-student basis.

Riverton resident Robin Smith said she would likely oppose the initiative.

Though schools would benefit from additional resources, Smith said, a 17.5 percent tax hike — the difference between a tax rate of 5 percent and 5.875 percent — is too high for her to stomach

"It's quite a bit, especially when you don't get wage increases that high," she said. "It's a little tough when you're older and don't have children."

But St. George resident Alan Bassett said he supports the tax hike. Having watched his children and grandchildren go through Utah schools, Bassett said teachers and students alike struggle due to a lack of resources.

The tax rate increase is larger than ideal, Bassett said, but if it lands on the ballot — or if lawmakers enact a lesser tax hike for the same purpose — he would pay more to support schools.

"I'm willing to take it either way," he said, "because I think education is that important."

Our Schools Now leaders have stated repeatedly they'd prefer legislators to find new school funding themselves. A ballot measure requires simplicity, Karras said, whereas lawmakers are able to fine-tune the complexities of state tax policy.

But backers are prepared to push the initiative if the Legislature fails. "Unless we do some things to turn the right gears," said Karras, "we're not going to get it done."

Billy Hesterman, vice president of the Utah Taxpayers Association, said his group might favor increasing school funding, but opposes efforts to increase income tax rates.

The state's low rate has given Utah a competitive edge, Hesterman said, drawing businesses and economic growth that would otherwise have gone elsewhere. A better approach, he said, would be to adjust Utah's sales tax to capture more revenue.

Sales taxes feed into Utah's General Fund, while income tax supports the Education Fund. But because higher education is funded from both sources, Hesterman said, an increase in sales tax revenue could lessen the amount of income tax revenue that is used to support public colleges and universities.

"These are things we're open to and we'd like to see some good discussion on," he said.

In order to reach the ballot, Our Schools Now must gather more than 100,000 signatures throughout the state, a process that is expected to begin this summer. Utah's Legislature will convene at least twice before any initiative would reach the November 2018 ballot.

This year's general legislative session began Monday.

bwood@sltrib.com

Twitter: @bjaminwood