This is an archived article that was published on sltrib.com in 2010, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Brent Fowler, who pays 100 percent of the cost of health insurance for his employees, says the new health care tax credit for small businesses will let him continue the generous benefit for at least another year.

"The credit, is extremely important," said Fowler, president of Air and Sea International, a Salt Lake City freight-forwarding company whose insurance premiums have been rising about 13 percent annually for several years. "It will be a very big benefit to our company."

Carl DeFosse, who has never been able to afford health insurance for his employees, says the hefty credit isn't enough to push him off the fence. He fears the credit could be quickly wiped out by spiraling increases in health-insurance premiums.

"I think the credit is a help. But there needs to be something to stop the double-digit growth in premiums," said DeFosse, whose Wasatch Baskets and Gifts may be eligible for a credit of up to 35 percent this year. "What happens if we get a 30 percent bump next year?"

Across Utah, hundreds of small-business owners are assessing whether the new credit will help or hurt them — or make no difference at all. The credit has touched off arguments over how many businesses are eligible, whether it's another pointless federal program, and if it will make it easier for businesses to provide affordable coverage for their workers.

The credit is generous, but can be complicated to compute. Qualified employers will be able to claim a credit of up to 35 percent of their premium costs in 2010. The rate will jump to 50 percent in 2014. The credit for nonprofits will stay at a maximum of 35 percent.

To be eligible, employers must have fewer than the equivalent of 25 full-time employees and pay at least 50 percent of the cost of health care coverage for at least some workers. Average annual wages must be under $50,000.

Finally, the credit phases out gradually for firms with average wages from $25,000 to $50,000 and for companies with the equivalent of 10 to 25 full-time employees.

The number of provisos has critics fuming. They say it's possible for a small business to meet some conditions of the credit but fall short on others.

"The qualifications are so tight," said Candace Daly, who runs the Utah branch of the National Federation of Independent Business, a small-business lobbying group. "The hoops that you have to jump through in order to qualify will automatically prevent most businesses from being able to take advantage of it."

Detractors also say estimates — official and otherwise — of the number of Utah businesses that the credit will benefit are too optimistic. President Barack Obama's administration says 40,500 small businesses in Utah may be eligible. In July, the advocacy groups Families USA and Small Business Majority said 37,800 businesses — 86 percent of all small firms in the state — were qualified.

The NFIB says the numbers are far smaller. It believes 14,200 Utah businesses probably qualify, just 26 percent of all small businesses in the state.

"To capture the full benefit of the credit, you need to have under 10 employees and a $25,000 average annual wage. That's going to be a challenge," said Aaron Call, vice president of sales for the Utah office of G&A Partners, a human resources consulting firm.

"Once you break the threshold of 11 employees [and wages over $25,000] the tax credit goes down," Call said.

Regardless of any shortcomings built into the credit, many businesses think the benefits will help them provide insurance to their workers.

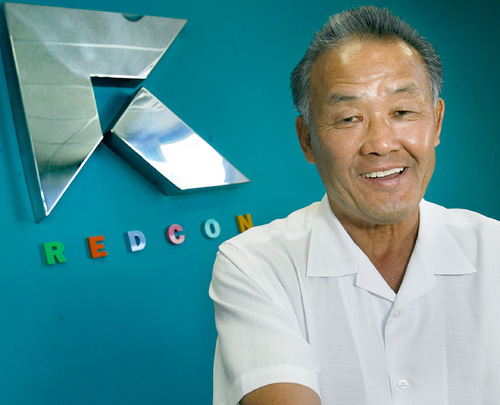

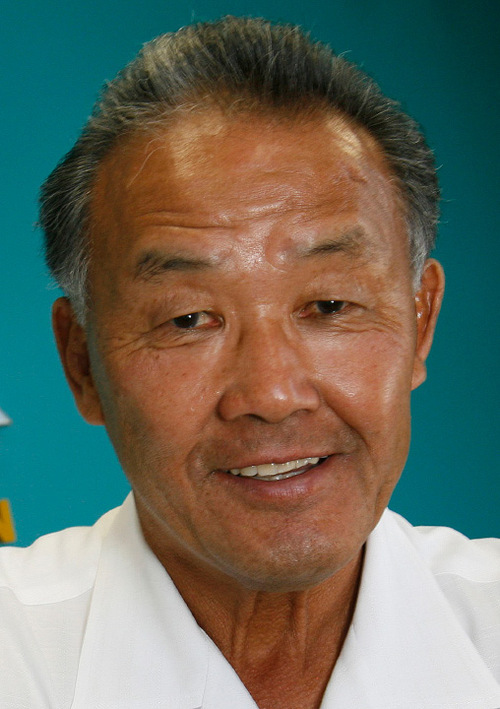

"I think it's good, because until this point I haven't had any relief of any sort," said Tom Hori, who owns REDCON Inc., a Bountiful-based surveying firm.

"Anything that might lean toward reducing the annual premiums going up, I'm willing to take a chance on," Hori said. "I can't help thinking it's going to work more to my favor than against me."

The credit probably couldn't come at a better time for Hori's 33-year-old company. Starting about eight years ago, REDCON's insurance premiums exploded. The average annual increase has been about 13 percent.

To cope, Hori dropped insurance benefits for the spouses and dependents of his 15 full- and part-time employees. He also sought out high-deductible plans. And he hasn't provided cost-of-living wage increases for a couple of years. Even so, health insurance premiums are his company's biggest expense.

"I know a lot of small businesses are concerned. But at this point, I haven't seen anything that is going to be alarming to me. I see it as something that is going to work in my favor," he said.

Kate Reddy, co-owner of McKinnon-Mulherin Inc., said the credit will save her Salt Lake City-based communications and training business about $2,000 a year. The company's insurance rates to cover 10 employees have jumped an average of 20 percent a year.

"Anything helps. It's certainly not the perfect scenario, but it's better than nothing," Reddy said.

Sweeping changes in health care

Marketing • With big benefit changes coming, insurers are taking a low-key approach. › E3

Insurance • The big winners in the first stage of health care reform are children. › A1