This is an archived article that was published on sltrib.com in 2011, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Utah's top-rated television station has been sold. The Sinclair Broadcast Group has agreed to pay $200 million for KUTV, its sister station, KMYU, and the five other stations that make up the Four Points Media group.

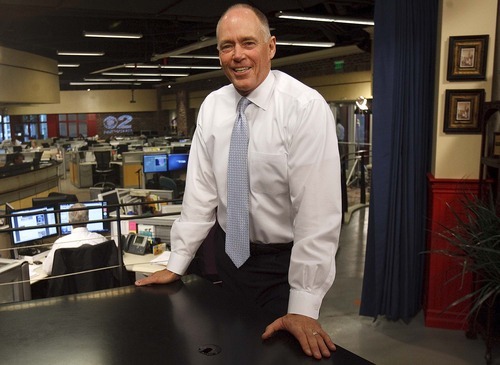

"This is a good thing," said KUTV vice president and general manager Steve Carlston. "And it's something we've always known would happen."

Cerberus Capital Management, one of the country's largest private equity investment firms, paid $185 million when it bought the Four Points stations from CBS in a deal that was completed in early 2008. (The other stations in the Four Points group are KEYE in Austin, Texas; WTVX-WTCN-WWHB in West Palm Beach, Fla.; and WLWC in Providence, R.I.)

But Cerberus was never in broadcasting for the long haul. "Anytime you're working in the venture capital world, there's always an expiration date for the investment. And that time had come," Carlston said. "Sinclair has a long-term broadcast business plan. They don't sell, they acquire."

The group has a reputation for cost-cutting and frugality, but Carlston said KUTV will fit right in. "We're very frugal," he said. "This is a very minimal station."

For nearly a year, KUTV has been the market's No. 1 news leader, despite operating with a staff that's far smaller than that of the No. 2 station, KSL-Channel 5.

"This is going to be one of Sinclair's golden assets," Carlston said. "It will be their strongest news station. We're the only station in the country in a major market that is No. 1 sign-on to sign-off and in all newscasts. Our market share and revenue is as strong as any CBS station in the country. So it's a real solid anchor for them."

The deal is subject to FCC approval. Sinclair and Cerberus expect the sale to close in early 2012.

Local viewers won't notice any changes anytime soon. Channel 2 will remain a CBS affiliate, and no immediate changes will be made to the station's news operation.

"All business operations stay the same," Carlston said. "The only thing they're going to see is bigger and better."

Sinclair President and CEO David Smith issued a statement welcoming Four Points employees and adding that he is "excited" about the acquisition.

"The stations, which are in prime middle markets, are a perfect complement to our portfolio of assets and TV footprint," he said.

The $200 million price is a bit of a premium in the current market. Stations have been selling for about five to six times their annual cash flow; this sale is closer to 10 times cash flow.

Smith estimated the deal will increase Sinclair's cash flow "by an incremental low-teen percentage in 2012."

Sinclair Broadcast Group's shares finished Friday up 18 cents, or $7.18, on the Nasdaq exchange.

Sinclair stations

Sinclair Broadcasting owns and/or operates 58 stations in Alabama, Florida, Illinois, Iowa, Kentucky, Maine, Maryland, Michigan Minnesota, Missouri, Nevada, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, West Virginia and Wisconsin. The group features 20 Fox affiliates, 17 from My Network TV, nine ABC, nine CW, two CBS and one NBC, and reaches 22 percent of American households.