This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Nearly 19,000 elderly Utahns, and millions more across the country, are being pushed into the digital banking world by the federal government.

Starting March 1, the U.S. Department of the Treasury plans to stop mailing out most paper Social Security checks. Instead, it will require recipients to switch to an electronic form of payment: either direct deposit into their bank account or onto a Treasury-issued debit card.

Although the vast majority — about 95 percent — of seniors in Utah already have their Social Security payments deposited directly into their bank or credit union accounts, for many of the remaining 5 percent the prospect is unnerving.

"There are some older seniors who are not comfortable with computers, and many of those people are worried about fraud on the Internet," said Laura Polacheck, associate state director of AARP Utah. "A lot of them grew up during the Depression and they just like the comfort of having that check in their hand."

Barbara Kidrick of Salt Lake City said she and her husband's Social Security checks are deposited directly into their bank accounts but that her late mother, Erma Wimmer, never warmed up to the idea.

"She lived in Grand County. It was six miles to the nearest Post Office and 32 miles to her bank in Moab. And even though I tried to tell her that having her Social Security check directly deposited was safe and would be a lot more convenient, she never would do it. She said she wanted that check in front of her so she could see it."

The switch away from mailbox delivery has others just plain upset.

Michigan resident Mike Clement told the McClatchy Newspapers service that he and his elderly mother were "hopping mad" that she was being forced to switch to electronic payment.

"It really should be a matter of personal choice," Clement said. "Unfortunately, the feds seem not to care a whit about personal preference."

Paul Runyan is president of Consumers for Paper Options, a Washington, D.C.-based group that has been fighting the Treasury Department's mandate. He said one of the big problems is that many senior citizens who have chosen to receive their Social Security checks through the mail are "unbanked," that is, they have no access to financial services.

"Those 5 million citizens who receive their Social Security checks through the mail deserve some consideration. They paid into the system, and receiving a check in the mail has worked well for them," Runyan said, adding that seniors who are uncomfortable with electronic deposits shouldn't be forced to navigate what for them could potentially be a confusing system of websites, online statements and personal identification numbers.

Runyan also said there are thousands of instances of direct-deposit-related fraud with Social Security payments every year although supporters of direct deposit contend that number is far less than what occurs with paper checks.

The Treasury Department describes its no-paper-checks campaign as primarily a cost-cutting initiative, estimating it will save around $1 billion in check-processing and mailing costs over the next 10 years. It also is promoting direct deposit as a safer and more convenient alternative to receiving a paper check.

Utah has 18,530 residents receiving paper checks, or 4.9 percent of the 377,925 total Social Security recipients in the state. That places Utah 40th in the nation in terms of its paper-check volume, according to the Treasury Department, which estimates the federal government will save $204,571 when those paper-check recipients in Utah are switched over to direct deposit.

Social Security recipients in Utah who haven't yet switched over to direct deposit shouldn't panic, though.

Walter Henderson, director of the Treasury Department's GoDirect Campaign in Washington, D.C., said those who ignore or miss the mandatory deadline won't be cut off or face penalties.

"We recognize that people depend upon their Social Security, and we're not going to stop sending them their checks," he said. "But what we will be doing is contacting those people and trying to help clear up any misconceptions they may have about direct deposit."

Those who are unbanked have the option of receiving a pre-paid debit card that is credited every month with their Social Security payment, Henderson said.

There is no application fee to get the card, and the first ATM withdrawal every month is free. Any subsequent ATM withdrawals will cost 90 cents. For those who do not want to use their debit card at an ATM, they have the option of getting cash back at any store where they use their debit card, he said.

A number of Utah seniors who already get their monthly Social Security checks deposited directly into their bank and credit union accounts said that they have no complaints about the process.

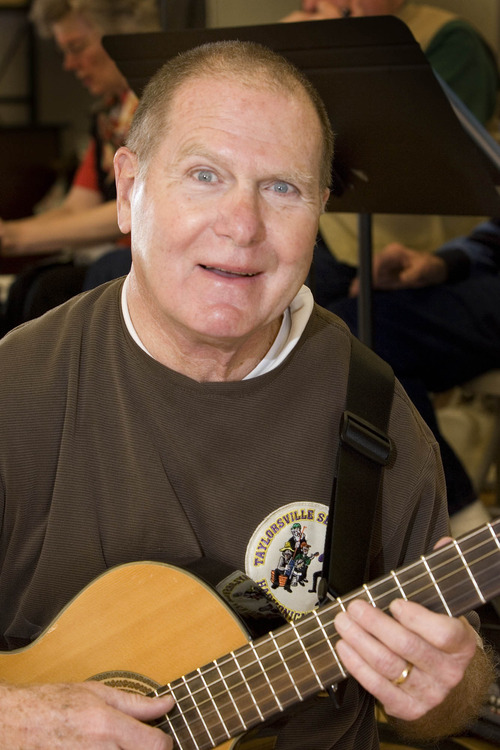

"One of the biggest hurdles I see is that a lot of seniors just don't like change," said David Murdock, 76, a retiree who worked in the state crime lab. "A lot of the older generation weren't raised with computers, so they are leery of them. But I think that once they see how convenient direct deposit is, they will love it."

And Murdock pointed out that even if someone gets a check directly deposited, no computer interaction is necessary. He said his check is deposited directly into his account at a local credit union, "and they send me a statement in the mail every month."

Twitter: @OberbeckBiz —

Utah's monthly Social Security data

Recipients • 377,925

Recipients with direct deposit • 359,395

Recipients getting paper checks • 18,530

Annual savings if converted to direct deposit • $204,571

Source: U.S. Department of the Treasury —

For direct deposit information

Utahns who would like to sign up for the U.S. Department of the Treasury's direct deposit program can go to http://www.godirect.org for additional details.