This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

For years, Amy Rees Anderson poured her time, energy and smarts into her business ventures, from a company selling and installing medical scheduling software to a leading health information technology business —MediConnect Global — which she sold last year for $348 million.

But becoming a tech executive was born out of necessity rather than design. At 29, she found herself divorced with two kids.

"I didn't plan to be an entrepreneur. I didn't have the formal training to be an entrepreneur," Rees Anderson said.

Intentionally or not, she's become a role model for women entrepreneurs in Utah, someone who's been able to find a niche, raise capital and grow an idea into a flourishing venture. And she insists she's not alone.

"We've found many women running businesses very quietly here in Utah," she said. "As I learn more and more about these [ventures], I'm actually really excited to see this going on."

Rees Anderson's optimism is confirmed by a recent report showing Utah among the states with the fastest growth in the number of women-owned companies. According to a survey by American Express OPEN, Utah ranks seventh in the number of women-owned firms added in the past 16 years (73.4 percent) and fifth in growth of company revenue (156.7 percent).

But even as the sector is growing, women-owned companies represent just a fraction of the state's overall business picture, census data show. Just 24.9 percent of Utah businesses are women-owned, well below the national average of 28.8 percent. Funding for women-owned ventures — particularly in the tech start-up space — remains tight. Fewer women are enrolled at the major MBA programs in the state. And there's a reluctance by many Utah women to enter high-end capitalism, for either work-life balance priorities, a slim network of contacts and mentors, a lack of fortune-building ambition or Utah's general cultural aversion to risk.

Still, Rees Anderson loves seeing more women in the local business scene and encourages more women to embrace entrepreneurship, "even those who want to be stay-at-home moms."

"If I could do it, I'm pretty confident anyone could do it," she said.

—

Lifestyle vs. high-growth entrepreneurs

With a bagel and sliced fruit at the ready, Demi Corbett types a blogpost over breakfast, one of a dozen women attending a morning session at the StartUp Princess WE (Women Entrepreneurs) Unite Conference held last month in Salt Lake City's Peery Hotel. The Orem resident launched an online jewelry business, StreetBauble.com, on the side, but last year, the company grossed $100,000, enough for her to quit her day job. A mother of two, she enjoys the freedom that comes with running her own company.

"I feel like I can grow this business, make more money and be more available to my family," she said.

Small-scale businesses such as StreetBauble.com make up the bulk of Utah's women-owned firms, says Linda Wells, director of the master's of business administration program and Sorenson Innovation Center at the University of Utah. Wells says women entrepreneurs in Utah seem to be less driven by the bottom line and more driven by flexibility.

"Here you see more micro-entrepreneurs, more lifestyle entrepreneurs as opposed to venture-backed high growth companies," Wells said. "You're going to see more women pursuing consumer products, health and beauty."

While that's not a value judgment, she says there's not as much financial potential with these types of ventures, so most professional investors steer clear of home-based businesses. She adds that there are currently no women pursuing entrepreneurship in the U.'s MBA program. That's a source of frustration to Wells, who came from Stanford University — the heart of Silicon Valley — two years ago. She's leaving the U. next month.

"So much of it is inbred in the culture here," she said. "It's not the expectation of women to grow up and have a professional career."

That comports with the experience of Carla Meine, former chief executive of O'Currance Teleservices, an in-bound call center she started and sold for $23 million in 2007. Meine, who reportedly is the first Utah woman entrepreneur to secure venture funding back in 1994 (Rees Anderson is reportedly the second), says so-called lifestyle businesses — firms founded to provide a comfortable income but little growth opportunity — far outnumber high-stakes ventures in Utah. In Utah, family comes first for women.

"I meet fewer men who want to create a lifestyle business," Meine said. "They definitely go into it with bigger goals. If you're a woman and you have a family, you feel your first obligation is to work around your family."

Finding work-life balance is one factor. Finding the money to launch a business is another, and funding these types of cottage enterprises costs less and comes more easily. Various grants and loans targeting women specifically are available. Kathy Ricci of the nonprofit Utah Microenterprise Loan Fund, which awards small business loans up to $25,000, says two-thirds of her clients are women. Lifestyle businesses also represent a big chunk of business for Zions Bank's Women's Financial Group, according to manager Cory Gardiner.

"Proportionately we see a lot of home-based businesses," Gardiner said. "This stems from values, how we [Utahns] choose to run our households."

—

Women in the tech sector

That's not to say there aren't women toiling in Utah tech start-ups, though their numbers are few. Cydni Tetro, Entrepreneur in Residence at Disney and executive director of the Women's Tech Council, says that's partly due to the reality that there's a dearth of women in science and technology.

"Obviously there are less women in the tech fields coming out of college, in engineering and computer science," Tetro said. "I think we have to start younger, get more women more comfortable with technology earlier."

Another part of what keeps female — and frankly, male — science and technology-based entrepreneurs at bay in Utah is a lack of local venture capitalists. It took Annette McClellan eight years before she got a portion of the $30 million it would take to bring DaisyClip, a permanent contraceptive device, to market. And that money didn't come from Utah investors. She flew to Boston and California's Bay Area to seal the deal.

"There aren't a lot of investors in Utah," McClellan said. "There are some angel groups, but only one that focuses on life sciences [which requires tens of millions to meet FDA requirements]. The numbers are tough when you're looking at the big raise [of capital]."

She sold her business last year for a "seven-figure" sum and is now looking for the next entrepreneurial adventure.

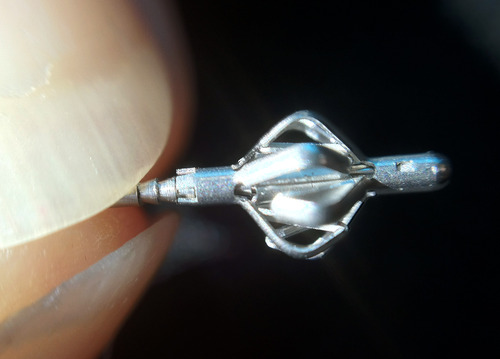

Vicky Farrar is another Utah tech entrepreneur. A patent lawyer whose husband (Dennis Farrar) has co-founded a dozen ventures including Myriad Genetics, Farrar is as well-positioned as anyone to fashion a successful start-up. She's been able to raise a "fair amount" of funding from local angel investor groups, but even with her extensive network, she says securing capital for her company, Catheter Connections, is difficult in Utah.

"The philosophy of some VCs (venture capitalists) here is that they will follow a great big fund, but they won't look at homegrown technology and say great, let's do it," Farrar said. "You can find a million dollars, but you have to piece it together."

Eventually, she went to the coasts to raise $20 million.

Still, it's not just access to capital. That kind of money also requires a strong stomach, and many say there's not much appetite to take sizable gambles in Utah. Suzanne Winters, whose many hats include former science adviser to Gov. Mike Leavitt, a bioengineer who worked on the Jarvik7 artificial heart and an angel investor, says local investors are very conservative in what they choose to finance.

"The capacity for risk is considerably lower here than other places," Winters said. "Many ask themselves, why would I invest in something that's going to take 10 to 15 years before I can make my money?"

In addition to the local low-risk culture, many say women themselves tend to hold back in the business arena, to play it safe. Judy Robinett, an entrepreneur, consultant and author, works hard to connect local women entrepreneurs with one another and with investors both here and on the coasts. She says women generally don't take enough risks in business.

"This is something I've struggled with myself," Robinett said. "It comes from self-confidence and from not having a broad network. Women don't network, they make friends. As an entrepreneur, you really need to believe that you can do it."

—

Looking toward the future

While there are few women in Utah's start-up environment, others see as a wide-open field of opportunity. Farrar of Catheter Connections says success will breed more success.

"I think it'll take time," Farrar said. "Utah is a great place to start up a company. I could not have started this company in California."

Meine, now CEO of IdealShape and a board member of the Women's Tech Council, said the recent emphasis on STEM (science, technology, engineering and mathematics) subjects for girls and women in high school and college will pay dividends.

"In the 10 years I've been mentoring, I'm seeing a shift," Meine said. "There's a lot of funding for women to go into math and science. Counselors, teachers and the private sector are offering support. Dads will take their daughters to work in the tech field and they see women in these fields. Inevitably you'll see a change."

Tetro of Disney adds that new activities such as an upcoming robotics competition and the recent DigiGirlz Day at Thanksgiving Point "open up doors you never imagined. We have to provide an environment where there's help to mentor them along."

Rees Anderson is doing her part to help that happen. On top of a new mentoring and angel investing firm called REES Capital and a foundation dedicated to teaching entrepreneurship, she's putting together a new fund specifically for women entrepreneurs. She won't give specifics yet, but says it's an idea whose time has come in Utah.

"I've told my daughter to be an entrepreneur," she said. "The one area of business where you have the best chance of making money and being home is to be an entrepreneur. I would love to see more women building businesses."

Twitter: @jnpearce —

Resources for women entrepreneurs

Got a great idea, but need help launching? Here are some good places to start:

Salt Lake Community College Women's Business Institute • Provides market research, one-on-one help with business plans and workshops on a variety of start-up topics. Nearly all services are free and you don't have to be a SLCC student to use the resource. More information at 801-957-5241 or wbi@slcc.edu.

Salt Lake Chamber Women's Business Center • Provides one-on-one consultation, trainings and networking events. More information at (801) 364-3631 or infowbc@slchamber.com.

Entrepreneur's Circle • Networking group which boasts 40 percent of its 1,000 members are women. More information about workshops and events is at http://www.meetup.com/Entrepreneurs-Circle/.

Entrepreneur Launch Pad • Networking group where members help brainstorm business plans, provide mentoring and share contacts. Weekly meeting schedule is online at http://www.entrepreneurlaunchpad.org/about/.

SCORE • Nonprofit offers mentoring, business counseling, free online business tools and webinars. There are three SCORE chapters along the Wasatch Front. More information at http://www.score.org/chapters-map.

Utah Microenterprise Loan Fund • Nonprofit provides loans up to $25,000 and management support to entrepreneurs who don't have access to traditional funding sources. Call (801) 746-1180 for more information.

U.S. Small Business Administration • SBA provides a variety of loans and assistance for the woman business owner. There are 26 SBA locations in Utah. More information at http://www.sba.gov/content/women-owned-businesses. —

Tips from Utah women entrepreneurs

Do your homework before launching. "When you really understand your customer, that's when you're ready" — Ann Mackin, SLCC Women's Business Institute

Hone your business plan. "A woman may have a fantastic idea, but needs to be able to articulate that to a bank" — Cory Gardiner, Zions Bank Women's Finance Group

Find a mentor. "Once I got tapped into the network of local women entrepreneurs, it became much easier to branch out" — Annette McClellan, entrepreneur

Explore crowdfunding. "Crowdfunding is going to radically change everything" — Judy Robinett, entrepreneur and consultant

Reflect on what you're building. "Creating a culture in a company, hiring the right talent: those are principles that will make or break you" — Amy Rees Anderson, entrepreneur and angel investor

Don't give up. "You've got to be tenacious and persistent and not accept no for an answer. No just means not now, it doesn't mean no" — Carla Meine, entrepreneur