This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

How do you restore trust once it has been lost? That is the question facing the next head of the Internal Revenue Service, the largest federal agency that interacts with the American public.

Over the last few months, we've seen countless revelations indicating that the IRS has shown both political bias as well as incompetence in administering the nation's tax laws. This is unacceptable, and the first priority of the next IRS commissioner must be to restore the agency's reputation and to rebuild the public's trust.

The Senate Finance Committee is now four months into its bipartisan investigation of the IRS's targeting of conservative groups applying for tax-exempt status. We've received comments from folks around the country, including groups from Utah. In May, I encouraged Utahns to come forward and help me in this investigation and share how they felt they were unfairly targeted while filing for this 501 (c)(4) tax-exempt status.

Frankly, at this point, there are more questions than answers about what exactly happened at the IRS.

Who conceived the idea to target groups with conservative-sounding names for extra scrutiny as the IRS processed their applications? How could that have been considered an appropriate option?

Why did targeting resume a few months after a senior manager shut it down?

And, perhaps most importantly, when did the commissioner and general counsel of the IRS, both of whom are not career civil servants, learn of the practice, and to what extent did they — or others in the Obama Administration — know about it or direct it?

We still don't know the answers to any of these critical questions.

That is why it is vital that the Finance Committee continue to methodically examine all of the evidence to determine how this practice began, why it was allowed to continue after it was discovered, and whether the IRS truly has stopped putting conservative groups through extra layers of scrutiny.

To carry out its investigation, the committee has interviewed more than a dozen IRS employees and is reviewing hundreds of thousands of documents. In the end, all the necessary facts must be brought to light so that Congress can come up with an appropriate solution and, if necessary, hold accountable those who were responsible for any wrongdoing.

While there is much that we still don't know, what we do know is that the IRS's cumulative actions demonstrate some of the worst bureaucratic bumbling that many of us in Washington have ever seen and the result is what may be an irreparable breach of trust.

How the IRS moves forward in addressing the handling of tax-exempt applications in the future, what guidance is issued about those applications and the rules promulgated by the IRS for their approval, and what actions are ultimately taken against the individuals determined to have directed the mishandling of applications to begin with, are all things that need to be addressed.

The president, in late July, nominated John Koskinen to serve as the next head of this agency. I've met with him and was blunt that the agency had not been nearly as cooperative as it should be in complying with this investigation. I was clear that many of us in the Senate will have many pointed questions for him about the targeting of conservative groups and what's been done to ensure this never happens again during the confirmation process.

If he is confirmed, Mr. Koskinen needs to ensure that every effort is made to address these issues. It is only then that the American public will be able to determine whether the IRS can regain their trust.

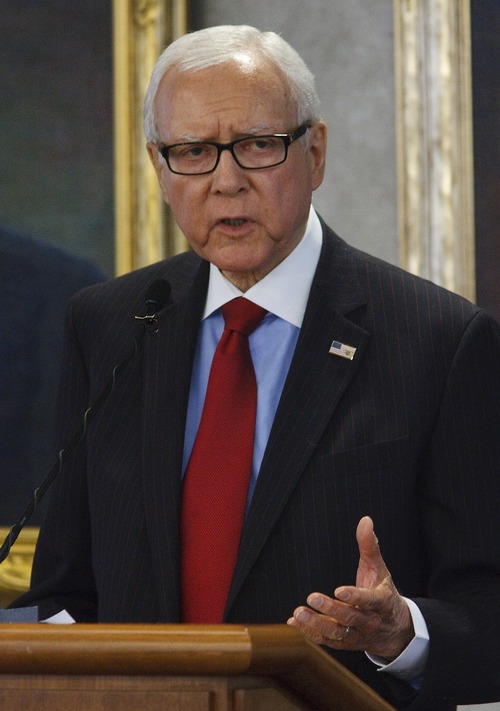

Orrin Hatch, a Republican, is the senior U.S. senator for Utah