This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

John Swallow brought to the attorney general's office a culture of special favors for big donors and a secret network of entities designed to hide his supporters from public scrutiny, investigators reported in their second day of damning revelations about Utah's former top cop.

"We have uncovered facts that suggest that state law may have been skirted or broken," said Steve Ross, a special counsel for the House Special Investigative Committee.

Swallow and his predecessor, fellow Republican Mark Shurtleff, gave big donors — such as Jeremy Johnson, the St. George businessman now facing federal fraud charges — extraordinary access in exchange for campaign contributions and special favors.

Swallow allegedly promised payday lenders that, as attorney general, he would be "ready and willing to help lead out" on staving off potential federal regulations.

Perhaps the most egregious finding: Days before he left office, Shurtleff unilaterally agreed to dismiss a lawsuit that could have helped thousands of Utahns facing foreclosure. The reason he settled, investigators said, was to spare Swallow political embarrassment.

"You see the danger of an official in essence hanging up a 'for sale' sign on the state's attorney general's office," said Steve Reich, another special counsel for the bipartisan House panel.

The two days of jaw-dropping revelations disgusted committee members and several said they now want to reverse course and continue the five-month probe that was shut down after Swallow announced his resignation Nov. 21.

Lead investigatorJames Mintz walked lawmakers through examples of special treatment and access given to well-connected friends and donors of Shurtleff and Swallow.

With payday lenders, it was the late Richard Rawle, owner of the Provo-based Check City payday-loan chain and a former employer of Swallow. For the online-poker industry, it was Jeremy Johnson, whom Swallow met when he was the finance chairman for Shurtleff's campaign.

Mintz told of a long-standing relationship, which included Swallow serving as counsel and lobbyist for Rawle's companies. Swallow had an attitude of "reverence" toward Rawle, Mintz said, and Rawle was generous to the Swallow campaign.

Mintz said Rawle gave Swallow $23,500 in consulting money, promised an ownership stake in a cement project, made $20,000 in contributions to otherentities to help Swallow's campaign.

Rawle also provided the campaign with free, unreported office space — likely a violation of state law.

Swallow courted the payday-lending industry, seeking to raise hundreds of thousands of dollars from it. But his campaign was sensitive to the public fallout of such heavy backing from a controversial industry, investigators said, so his political consultant Jason Powers set up political-action committees and nonprofits to hide the funds from voters.

"I do not want this to be a payday race," wrote Swallow, then a chief deputy attorney general.

He directed the loan companies to either steer their contributions to the nonprofits that did not have to disclose their donors or give their money through entities not tied to the payday industry.

"This is our No. 2 cop from the state of Utah, who's here to protect citizens of the state of Utah and he's cutting a deal in his election with a group of predatorial lenders," said Rep. Mike McKell, R-Spanish Fork. "I think it's very, very problematic and he tried to hide it."

Said Mintz: "That kind of flow of benefits, back and forth with elected officials, is pay to play. If it isn't dirty, why is it kept so secret?"

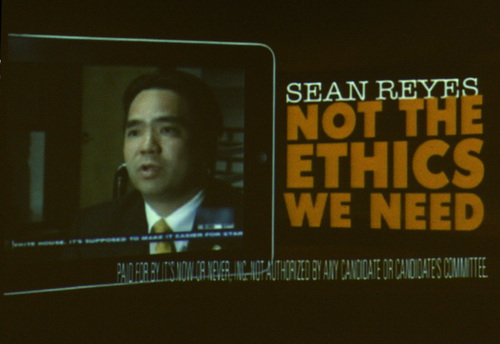

He said Swallow and Powers raised more than $452,000 through Powers' nonprofit, the Proper Role of Government Education Association, with Rawle, the largest donor, giving $100,000. It funneled the money through other nonprofits and used it in scathing TV and radio attack ads against Swallow's GOP primary opponent, Sean Reyes, then publicly denied any connection to the spots.

Powers also targeted former state Rep. Brad Daw, R-Orem, hammering him with damaging mailers and phone calls to voters disparagingthe then-lawmaker, who had sponsored legislation opposed by the payday industry.

"The payday [loan] industry provided a huge benefit to John Swallow by helping to defeat his opponent," Mintz said, "and Swallow, through his campaign, provided a huge benefit to Richard Rawle and the payday industry by helping defeat their opponent."

McKell bluntly stated that "there are some people who need to go to jail."

"I'm going to go out on a limb and say that," said the lawmaker, specifically addressing FBI agents and a state Department of Public Safety investigator who sat in the back of the committee room.

The Coalition of Religious Communities — a longtime critic of payday lenders — called Friday for a separate investigation into that industry by the federal Consumer Financial Protection Bureau. "The undue influence this agency has had in the Utah attorney general's office," it said, "has allowed that industry to behave in an outrageous manner with impunity."

The committee also laid out an effort by Johnson to persuade Swallow and Shurtleff to give the state's blessing to processing payments for online poker in Utah.

Johnson was part owner of thenow-defunct SunFirst Bank in St. George and a partner in a company that was processing poker payments.

Assistant Attorney General Thom Roberts, who handles poker issues in the office, said Johnson and Swallow "engaged in a continuing dialogue" to see if there was "wiggle room" in state law on poker processing.

Roberts was not involved in those discussions, he said, nor was chief deputy attorney general Kirk Torgensen, who oversaw criminal cases — such as illegal gambling.

At the same time Johnson was pressuring Swallow to approve the poker payments, he let Swallow use his 75-foot floating mansion on Lake Powell at least three times, Mintz said. Johnson, at Swallow's request, lined up donors for Sen. Mike Lee's campaign — which also employed Powers — and Johnson and Swallow discussed taking an Alaskan retreat on Johnson's luxury jet to plan Lee's campaign. The trip apparently did not take place.

"Just ask yourself," Reich said, "if the average citizen, someone other than Jeremy Johnson, had wanted access to the office on their issue, do you think it's likely they would have had access to the attorney general and chief deputy?"

Friday's proceedings concluded with the story of Tim and Jennifer Bell, a Utah couple suing Bank of America, challenging the financial giant's attempt to foreclose on their home. The state later joined their suit on behalf of about 5,000 Utahns whom the bank foreclosed upon and 13,000 who had received notices.

In August 2012, the Bells staged a lavish fundraiser for Swallow at their home, where, Mintz said, it appears Swallow first connected Tim Bell to the case the attorney general's office was handling.

Rather than recuse himself as a result of the conflict, investigators discovered, Swallow remained closely involved in negotiations with the bank and in contact with the Bells.

On the eve of November's 2012 election, Bell contacted Swallow and asked for help on his mortgage modification on the couple's home — the same one where they hosted the fundraiser — which was approved two days later. Bank of America agreed to forgive more than $1 million of Bell's principal and reduce his interest rate from 7.5 percent to 2.6 percent.

Even though the Bells settled, attorneys for the state saw their case as the best shot to help thousands of Utahns in similar predicaments and,thanks to a favorable ruling by a federal judge, wanted to continue.

Shurtleff unilaterally killed that notion Dec. 27, 2012, when he signed an agreement to dismiss the matter — without consulting other office attorneys.

In an email, the lawyer who had been handling the case demanded to know why Shurtleff had done that.

"This was becoming a very complicated issue for John," Shurtleff replied, "given Bell hosted a fundraiser for him in the subject home and Bell is also a person of interest in a fraud matter we are investigating."

Rep. Francis Gibson, R-Mapleton, was dumbstruck by the email. "Are you saying the attorney general dropped a case with legitimate interest for homeowners in the state of Utah to protect Swallow from the conflict?"

Reich said the pay-to-play pattern leads him to believe that was the case.

"It's an effort to hide from public scrutiny," Reich said, "the very bad situation and inappropriate situation that Mr. Swallow had put himself in."

The campaign later contacted the Bells and asked them to revise the estimated cost of the fundraiser, initially listed at $15,000. They lowered the tab to $1,000. In reality, Mintz said, receipts show the price tag topped $28,000.