Francisco Kjolseth | The Salt Lake Tribune

Janice Rowberry joins other opponents and supporters of fraudster Dee Randall, who appe

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, appears at the Matheson Co

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, appears at the Matheson Co

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Mathe

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Mathe

Francisco Kjolseth | The Salt Lake Tribune

Prosecutor Jake Taylor attends the sentencing of admitted fraudster Dee Randall, a Kays

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Mathe

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Mathe

Francisco Kjolseth | The Salt Lake Tribune

Joseph Sherm who lost 150,000 when he invested with admitted fraudster Dee Randall, sec

Francisco Kjolseth | The Salt Lake Tribune

Sarah Bradshaw, daughter of admitted fraudster Dee Randall, in background, speaks in su

Francisco Kjolseth | The Salt Lake Tribune

Janice Rowberry expresses her anger over losing 100,000 of her retirement when he inves

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, right, a Kaysville insurance agent, appears at the Math

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, addresses 3rd District Jud

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, appears at the Matheson Co

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, is handcuffed at the Mathe

Francisco Kjolseth | The Salt Lake Tribune

Janice Rowberry joins other opponents and supporters of fraudster Dee Randall, who appeared at the Matheson Courthouse for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney's Lacey Singleton and Wojciech Nitecki for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney Lacey Singleton for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

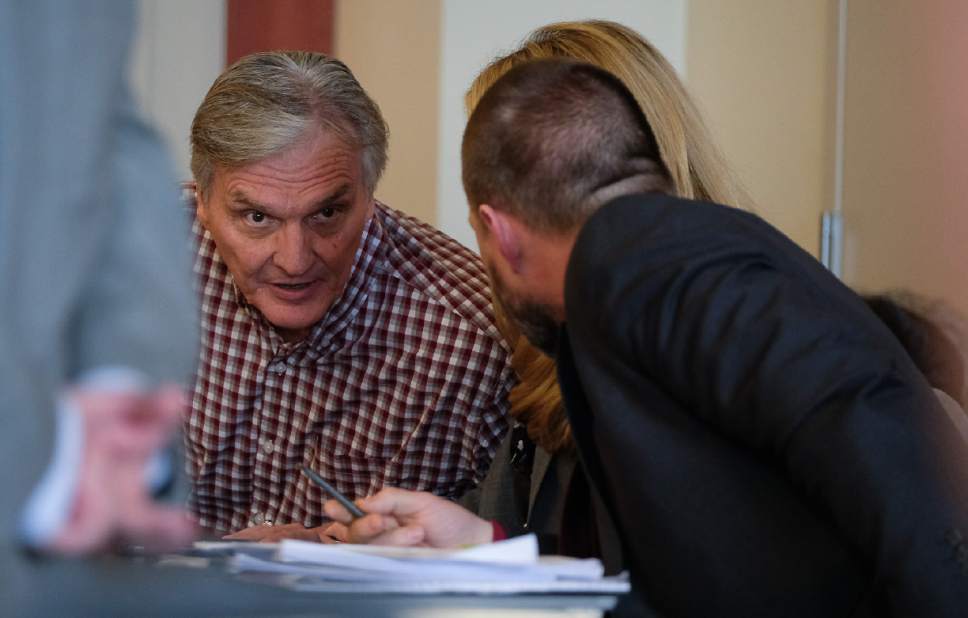

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney's Lacey Singleton and Wojciech Nitecki for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney's Lacey Singleton and Wojciech Nitecki for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Prosecutor Jake Taylor attends the sentencing of admitted fraudster Dee Randall, a Kaysville insurance agent, as he appears before 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney's Lacey Singleton and Wojciech Nitecki for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, left, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney's Lacey Singleton and Wojciech Nitecki for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Joseph Sherm who lost 150,000 when he invested with admitted fraudster Dee Randall, second from right, speaks in support of jail time at the Matheson Courthouse during sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Sarah Bradshaw, daughter of admitted fraudster Dee Randall, in background, speaks in support of her father as the Kaysville insurance agent, appears at the Matheson Courthouse for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Janice Rowberry expresses her anger over losing 100,000 of her retirement when he invested with admitted fraudster Dee Randall, at right, as she speaks at the Matheson Courthouse during sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, right, a Kaysville insurance agent, appears at the Matheson Courthouse, alongside his attorney Wojciech Nitecki for sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, addresses 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017 prior to his sentencing for jail time. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, appears at the Matheson Courthouse, as he listens to sentencing by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall who was sentenced to jail time pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.

Francisco Kjolseth | The Salt Lake Tribune

Admitted fraudster Dee Randall, a Kaysville insurance agent, is handcuffed at the Matheson Courthouse, after being sentenced to jail by 3rd District Judge Mark Kouris on Monday, Feb. 6, 2017. Randall pleaded guilty in July of last year to five charges related to his operation of a Ponzi scheme that took in more than $72 million from about 700 people.