This is an archived article that was published on sltrib.com in 2017, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

From a distance, developer Terry Diehl seems to have had it all.

He lives in a $4 million house on nearly 7 acres at the mouth of Big Cottonwood Canyon, drives fancy cars, has a country club membership, $5,000 worth of wine and a wine cellar to store it, and the cachet to run up $300,000 of Las Vegas casino debt in a single night.

It's a life wrapped in the trappings of a successful real estate developer's career that has been fueled by decades of high-risk business deals and cozy relationships with power brokers that some say allowed the former Utah Transit Authority (UTA) board member to bend — if not break — the rules.

At 61, Diehl (could the name be more apt?) has been behind some of the biggest real estate deals along the Wasatch Front and helped shape Utah's award-winning public transit system, while weathering countless civil lawsuits, rumors about having politicians in his back pocket and two scathing legislative audits that, in part, challenged his role in more than one multimillion-dollar land deal surrounding UTA transit-station developments.

Now, those same land transactions may be Diehl's undoing.

On April 5, a federal grand jury indicted Diehl on 12 criminal counts related to his 2012 bankruptcy, renewing old allegations that he may have misappropriated funds from business deals and used insider information from UTA to influence decisions and enrich himself.

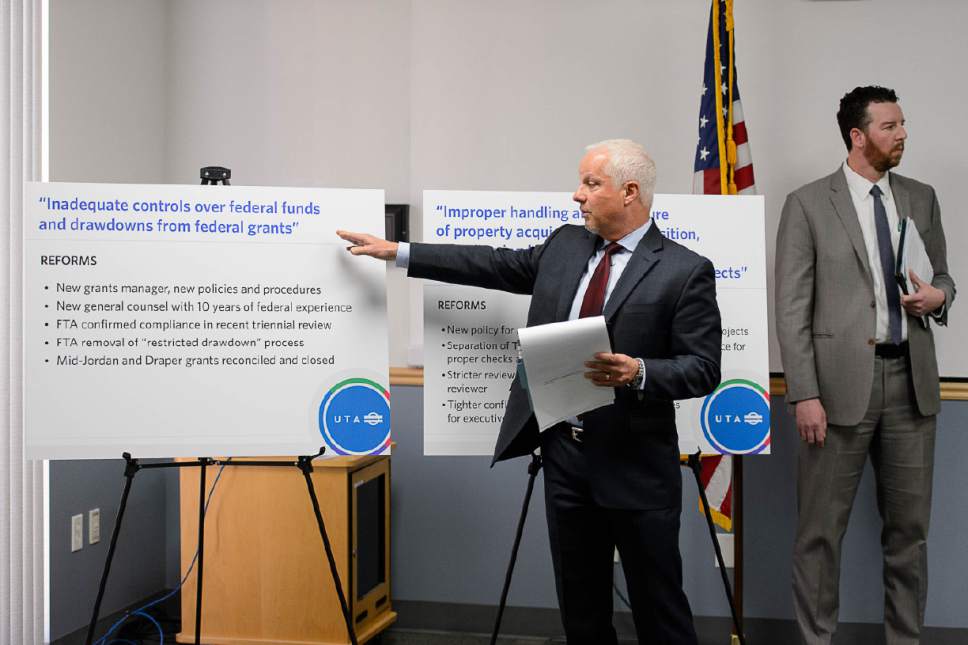

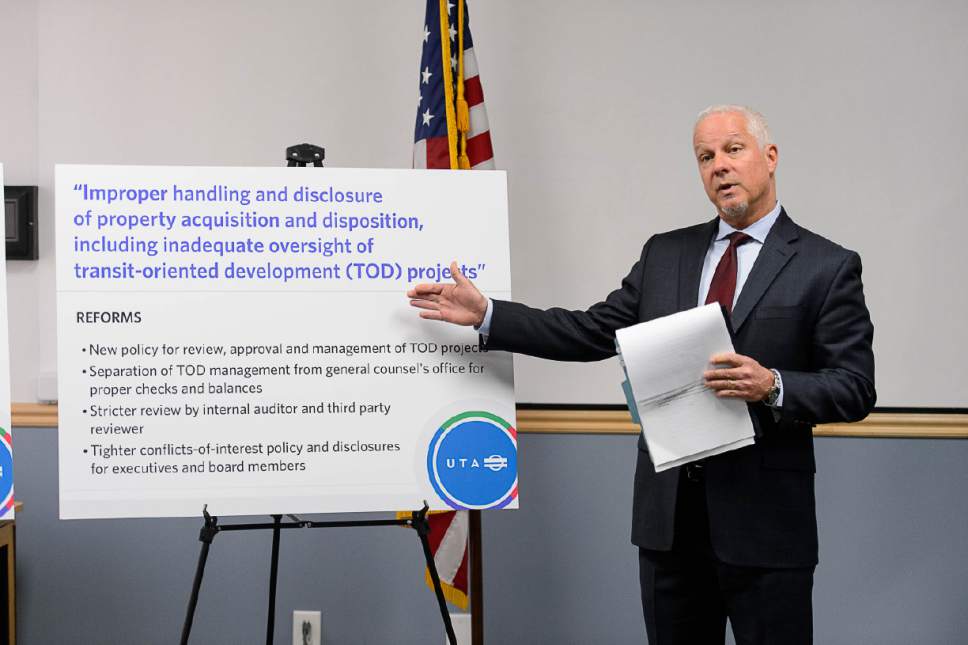

The indictment followed on the heels of an announcement that Utah's U.S. attorney's office had struck an immunity deal with UTA in exchange for the agency's cooperation in an ongoing investigation into current and former UTA officials and others involving property purchases and developments around transit stations.

The charges allege that Diehl falsely reported his income or concealed assets — including more than $1 million from the sale of land interests near the Draper FrontRunner station — that should have been disclosed to the bankruptcy court.

Diehl maintained his innocence in a text message to The Salt Lake Tribune on the day the indictment was made public.

"I obviously disagree with the government regarding the details involved with my bankruptcy," he wrote. "I look forward to proving my innocence and having my day in court."

—

Mum's the word • Diehl declined a request for an interview for this story. He isn't the only one.

The Salt Lake Tribune called more than two dozen individuals with ties or past dealings with the developer, with little success.

Most, including some Diehl family members, failed to return messages, or declined to comment.

Others — UTA's former top attorney Bruce Jones among them — insisted they just didn't know Diehl well.

"He was on the board of UTA and I was general counsel," Jones said. "That's my only interaction with him. … There are better sources."

Actually, Jones worked closely with Diehl for years when Jones was in charge not just of UTA legal affairs but also oversaw developments at train stations as Diehl and others bought properties and moved forward with construction of housing, retail stores and offices. Moreover, Jones and Diehl had worked together when Jones was a Cottonwood Heights councilman supporting the developer's controversial Tavaci project in that city.

Utah House Speaker Greg Hughes, R-Draper, who in the past has publicly acknowledged his tight friendship with Diehl, also has gone silent. Through a spokesman, Hughes declined to comment, pointing The Tribune to a statement issued by his attorney the day Diehl's indictment was handed up. In it, attorney Brett Parkinson said Hughes "has offered and continues to offer his assistance" to federal authorities, and "out of respect for their investigation, we cannot comment further."

There's a reason no one wants to speak publicly about Diehl, says Claire Geddes. "They are scared of him."

A longtime government watchdog who fought UTA on the Draper station and battled Diehl over the Big Cottonwood Canyon-area Tavaci development, Geddes said she, too, had to be careful.

"I'm only saying things that are already public," said Geddes. "I don't want to get sued."

—

Cliff's edge • Orrin Colby Jr., who served with Diehl on the UTA board, was more generous with his impressions, noting Diehl's smarts and large, fun-loving personality.

"He enjoys having people around him, particularly well-connected people," Colby said.

He also "lived high" on what appeared to be ample assets, Colby said, but was known for his generosity to others and his risk-taking nature.

Colby also said that trying to characterize Diehl reminded him of an anecdote about interviewing stagecoach drivers in the Old West. The critical question: whether the applicant might drive his rig within 6 inches of the cliff, or stay far away.

"Terry is more of a 6-incher," Colby said.

Salt Lake County Councilman Jim Bradley said Diehl is not unlike others who seek the county's blessing on big development projects.

"He was usually asking for things that were totally out of a sense of appropriateness," Bradley said, "and also always had some cloud of misdoing around him."

Bradley recalled his discomfort with Diehl in the 1990s when the county bought the South Mountain Golf Course from Diehl.

"I thought the county was disadvantaged in terms of transactions out there," said Bradley. "I can't remember the details, but it was a fast one, like all his things are."

The county paid much more than was reasonable, according to an audit, and the deal ended on a sour note, Bradley said.

"They didn't sell the golf carts to us," Bradley said. "We had to go back and spend several hundred thousand dollars to buy the golf carts. It was just crap like that."

Geddes said Diehl and his projects have long benefited from having friends in high places. Hughes, for example, served on the UTA board with Diehl and showed up at the developer's side for a Tavaci-related Cottonwood Heights City Council meeting, where Diehl also had the support of Jones, a councilman.

"He's a very well-connected developer who is able to do a lot of things that most people wouldn't be able to do," she said.

There's also been a widely held perception that Diehl benefited through the years from his close relationship with the late Salt Lake County Councilman Randy Horiuchi, who lived in Diehl's well-appointed 9,200-square foot home for a while following a divorce.

At a 2013 council meeting, Horiuchi spoke in favor of the Tavaci development as he chastised environmentalists for their opposition and their criticism of his friendship with Diehl. He even complained of being photographed by activists at Diehl's house before unapologetically voting for the project — albeit on the losing side.

The two were "very, very close," Bradley said.

—

UTA deals • First appointed to the UTA board in 2001, Diehl is said to have cultivated support not only from Hughes but also from former House Speaker Greg Curtis, a Sandy Republican who later became a UTA lobbyist. Curtis, Diehl and Hughes all were involved in site-selection decisions for the train station in Draper back in 2008 and 2009.

At the time, Diehl was not only a UTA board member but half-owner of a company that held an interest in the property adjacent to the planned FrontRunner site — a fact that came to light later, through a civil lawsuit filing and a 2010 legislative audit, which concluded Diehl may have violated Utah's law concerning the misuse of insider information and made in the neighborhood of $20 million on the deal.

Auditors in a subsequent investigation in 2014 criticized UTA's sweetheart deals, extravagant pay and bonuses and found that UTA was acting like a bank for developers, including $10 million that was paid in December 2010 to one-time Diehl partner Jeff Vitek for a parking garage at a time when there were no plans to build one.

Between the two probes, Diehl resigned from the UTA board in 2011 amid lingering conflict-of-interest allegations but not before Hughes and the rest of the trustees granted him a waiver from normal rules banning former board members from doing business with the agency for one year. Within months, he was back at UTA headquarters looking for business. Then, on March 30, 2012, he filed for Chapter 11 bankruptcy, listing $3.58 million in assets and $47.5 million in liabilities.

—

Broke, not busted • Included among Diehl's detailed assets: His five-bedroom, six-bath (with separate guest quarters and private office) Cottonwood Heights home listed at $2.3 million — although it is currently on the market at a "huge discount" of $3.95 million — $1.1 million condo on Coronado Island, Calif., along with a Cadillac Escalade worth $40,000, a Mercedes worth $20,270, 80 bottles of wine valued at $5,000 and a Glen Wild County Club membership of $87,000.

On paper, it seems like an enviable life.

But court filings show Diehl's homes and vehicles were encumbered with debt and say he owed more than $35 million to financial institutions and his former business partner, Michael Bodell.

The bankruptcy appears to have been triggered by a bank's move to foreclose on Diehl's home. But documents filed in the case show Diehl did not appear to be slowing his spending as the bankruptcy loomed.

Beginning on Feb. 19, 2012, Diehl charged $11,907.27 on a Diners Club credit card, purchasing plane tickets on two Philippines-based airline carriers in March and charging a March 19 payment for services at a plastic surgery clinic in Tijuana, Mexico, along with a string of other purchases, including multiple payments to Western Union, the documents show.

Diehl also owed $450,000 to casinos, $300,000 of that to the MGM Grand in Las Vegas.

MGM's claim says that Diehl drew four checks from the casino all on the same day — March 28, two days before the bankruptcy filing. In addition, he owed $150,000 to the Aria casino, although the date he incurred that debt isn't stated.

Federal prosecutors contend that Diehl lied about his gross income during the two years leading up to the bankruptcy, claiming an income of just $376,708.83.

"In truth and fact, defendant Diehl received over $1 million in gross income from the operation of his business involving real property stemming from a UTA FrontRunner transit oriented development at 12800 South in Draper beginning in 2008," the charges state.

—

The other side? • Draper resident Joan Little acknowledges she raised a glass of wine or two when she heard that Diehl had been indicted.

The former head of the South Mountain Homeowners Association was among residents who complained to her city's council about Diehl at the time of the train station planning. In an email — subject line: "Who owns Draper City" — Little challenged the council's support for the transit development project and the changes being made to city ordinances, all of which benefited Diehl.

Little said she spoke up after watching Diehl essentially direct the rewriting of the municipal code by the city manager and staff during a November 2008 meeting.

"Why would he be dictating a city code?" she said, adding that she understood Diehl to be the developer in line for the project. "That's why I questioned, why would the developer be involved?"

In the email, which she provided to The Tribune, Little asked the city to hold off on voting to approve changes to city code and a developer agreement, which she said would "saddle Draper citizens with millions ($20+ million and counting) of dollars of infrastructure costs that will benefit only the developer Terry Diehl."

In a response, Councilman Jeff Stenquist called Little "grossly misinformed."

"Mr. Diehl is not the developer on the project but rather his involvement has been due to his position on the UTA board of directors," Stenquist wrote.

Colby, who was the vice chairman of UTA's board when the Draper station deals were inked in 2009, said questions about Diehl's alleged maneuvering on the Draper project were raised as he was leaving the board.

"I never took an opportunity to personally confront him about this," Colby said, adding that he "never once felt like Terry told me a lie."

In fact, his bent for pushing the envelope and thinking outside the box was often good for the board, Colby said, because he prompted questions and discussion that helped trustees see possibilities that were not otherwise obvious,

That Diehl filed bankruptcy isn't too troubling, Colby said, because many of developers have been tossed around on the boom-and-bust waves of real estate.

He also said he's reserving judgment about the criminal charges brought by federal prosecutors.

"I've been close enough to legal matters in my career that I've learned charges are easy to come by," he said. "There is always another side to the story, and I don't think we've heard that yet."

— News Editor Dan Harrie contributed to this report.