This is an archived article that was published on sltrib.com in 2012, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Logan • Although the dream of most of America's workforce is unlimited leisure time and an equal amount of discretionary funds, James Bullard and other leaders of the Federal Reserve are concerned with harsh reality.

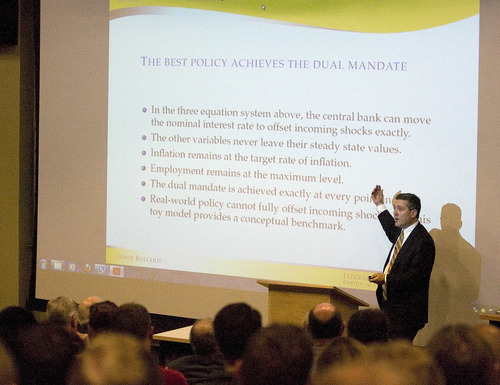

Charged with setting monetary policy to best manage the index of well being in the United States, the Federal Reserve and its key committees have strong points and weak ones, Bullard told an overflow crowd Monday while delivering the 2012 George S. Eccles Distinguished Lecture in Economics at Utah State University.

Bullard, 51, is president and CEO of the Federal Reserve Bank of St. Louis and member of the powerful Federal Open Market Committee (FOMC). St. Louis is one of 12 regional banks that influence the flow of money and credit in the nation's economy.

The 19-member FOMC, appointed from private and public sectors, makes key decisions about the growth of the U.S. money supply. Bullard said the committee's January 2012 choice to publicize a target inflation of 2 percent was an important step toward maximizing employment and stabilizing prices to allow Americans to enjoy a comfortable balance between having enough money and the leisure time enjoy it.

"Congratulations to [Fed] Chairman [Ben] Bernanke on this important accomplishment," Bullard said, adding that the European Central Bank is also following this strategy. "It makes sense to explicitly name the inflation target as opposed to hiding it, which adds uncertainty to the macroeconomic system."

When the FOMC convenes next week, Bullard said he doesn't expect changes on the near-zero interest rate. A report issued Monday showed strong growth in retail sales in the first quarter. Other signs of progress are that labor markets are improving, unemployment has been ticking downward, and sectors such as technology, agriculture and energy are doing quite well, Bullard said. But parts of the economy, such as housing and some financial markets, are slowly recovering, he said.

Central bank officials have suggested the economy would need to deteriorate, and inflation would need to remain below its 2 percent target, for them to consider more stimulus in the form of bond purchases — a controversial move that would increase the Fed's balance sheet from almost $3 trillion.

"Generally the economy is improving, repairing from a very big shock that has done a lot of damage. It could be many years before we recover," Bullard said in a press conference after the lecture. "I still think that the economy is on track for now, and the best thing to do is gather more information and see if the improvement in the economy we've seen in 2012 can sustain itself. I think it's possible that we'll get 3 percent growth in the economy this year."

At its past two meetings, the central bank said it expected to keep rates "exceptionally low" at least through late 2014. Fed policymakers, however, give individual forecasts, and Bullard said on Monday that he still expects the Fed to raise rates late in 2013.

Reuters contributed to this story.